Customized 1031 Exchanges

Our customized 1031 Exchange approach will help you develop a strategic plan that is unique to your specific investment needs.

What is a 1031 Exchange?

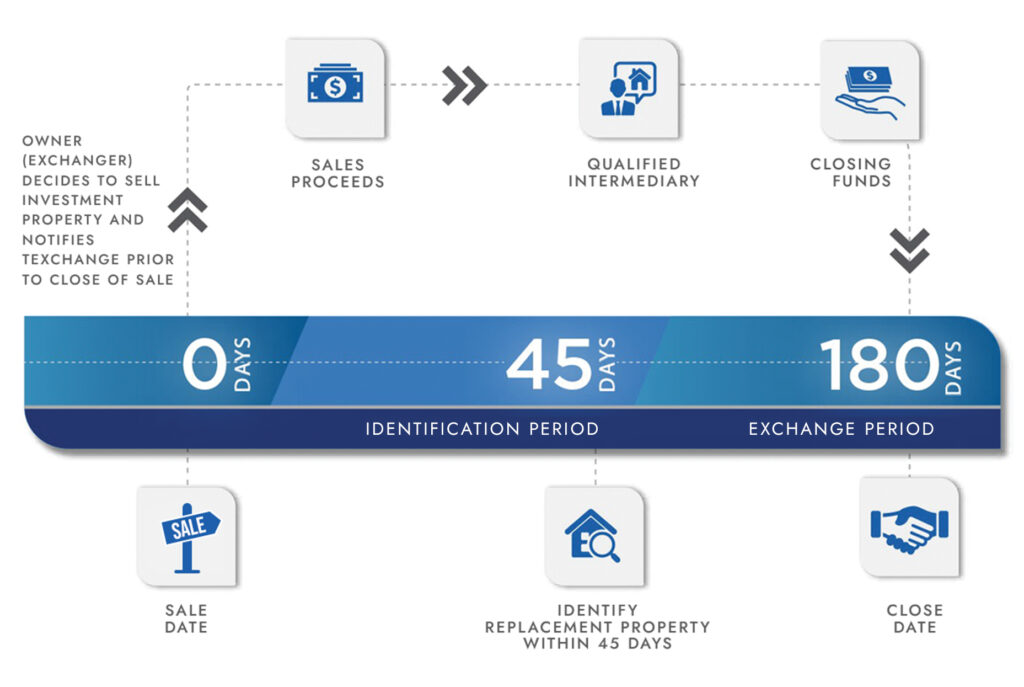

Section 1031 of the US internal Revenue Code is an effective strategy for deferring the capital gains tax that may arise from the sale of investment property. By exchanging the property for like-kind real estate, property owners and investors may defer their tax and use all of the proceeds for the purchase of replacement property.

$1,000,000 of exchange proceeds, although the Manager may accept an investment of a lesser amount at their discretion.

Typically 5-7% – Please see deal-specific PPM for target return.

Potential for year-end bonus distributions based upon overall financial performance of the property.

To the extent financial targets are achieved, financing may give the ability to return some or all of principal invested in a tax-deferred way.

- Detailed bi-annual performance reports

- Audited year-end financial statements

Please contact TEI for additional details.

In order to help ensure TEIs interests are aligned with its investors, TEI typically co-invests more than the industry average in its acquisitions alongside 1031 investors.

GET STARTED WITHA 1031 EXCHANGE

If you are interested in learning more about the ![]() program, please fill out the information below and one of our experts will be in touch with you shortly.

program, please fill out the information below and one of our experts will be in touch with you shortly.

USING INDEPENDENT THINKING TO PROVIDE CUSTOMIZED 1031 EXCHANGES

A 1031 exchange is an effective tool to defer capital gains tax, but equally important is choosing a company with the expertise to guide you through the specific timelines and procedures that must be followed to take advantage of the benefits. TEI has been transacting 1031 exchanges for its own portfolio and outside investment partners for decades using dedicated in-house legal, tax, and acquisition teams. With significant in-depth knowledge and technical expertise, TEI is able to structure and customize the exchange to fit your specific investment objective.

Using ![]() , you can work with our in-house team to develop a customized strategic plan to maximize the benefits of your 1031 exchange.

, you can work with our in-house team to develop a customized strategic plan to maximize the benefits of your 1031 exchange.

A 1031 exchange is an effective tool to defer capital gains tax, but equally important is choosing a company with the expertise to guide you through the specific timelines and procedures that must be followed to take advantage of the benefits. TEI has been transacting 1031 exchanges for its own portfolio and outside investment partners for decades using dedicated in-house legal, tax, and acquisition teams. With significant in-depth knowledge and technical expertise, TEI is able to structure and customize the exchange to fit your specific investment objective.

Using ![]() , you can work with our in-house team to develop a customized strategic plan to maximize the benefits of your 1031 exchange.

, you can work with our in-house team to develop a customized strategic plan to maximize the benefits of your 1031 exchange.

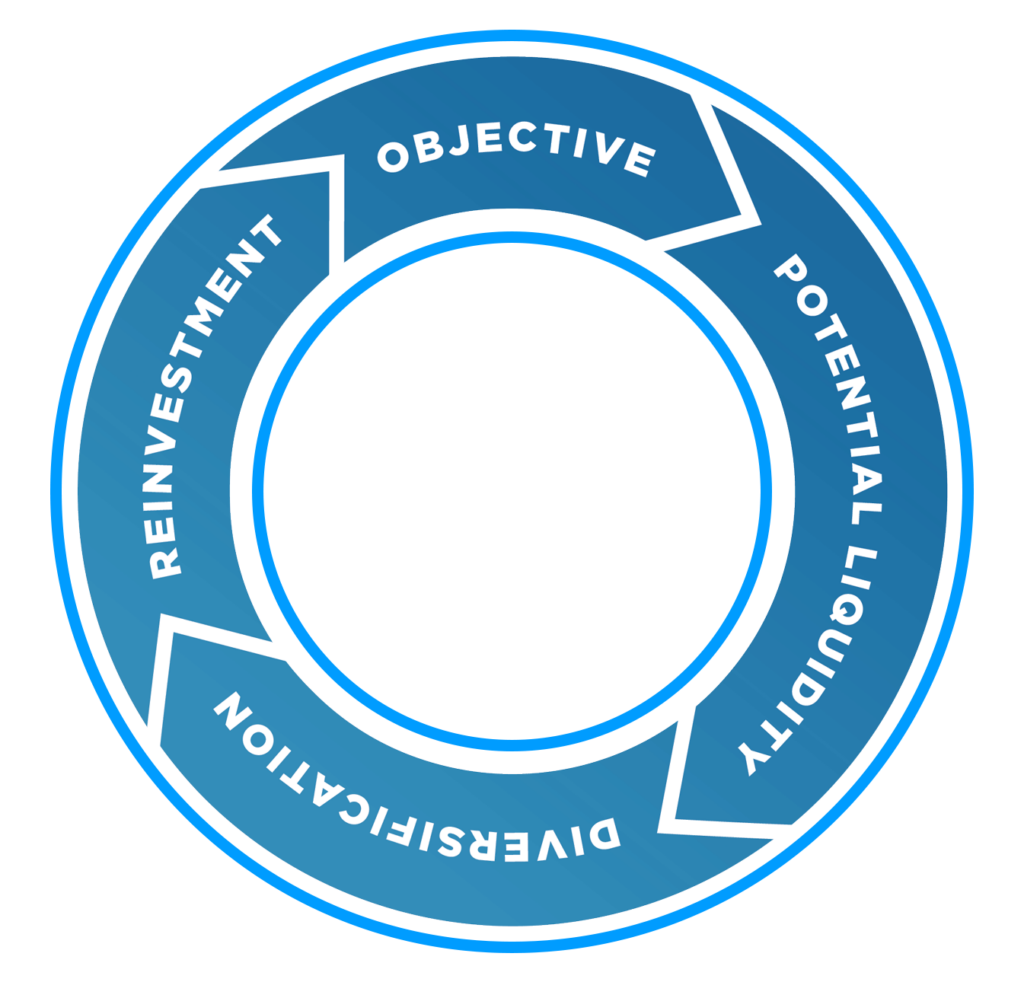

OBJECTIVE

Produce a sustainable, long-term, growing income stream with the potential for value enhancement.

POTENTIAL LIQUIDITY

A subsequent financing, to the extent value enhancements are achieved, gives you the ability to cash out your investment on a tax deferred basis.

DIVERSIFICATION

Diversify holdings by purchasing partial interests in multiple properties.

REINVESTMENT

Compound returns through additional TEI investment opportunities.

PRIMARY RISK FACTORS MAY INCLUDE (ALTHOUGH NOT LIMITED TO):

• This investment involves a substantial degree of risk, should be considered speculative, and an investor may lose their entire investment;

• No public market exists for the investment units (shares) and it is highly unlikely that any such market will ever develop;

• Substantial restrictions exist upon the transfer of shares;

• Lack of liquidity;

• Use of leverage, uncertainty as to the amount and type of leverage to be used, and a lack of any binding financing commitments;

• Limited portfolio diversification;

• Risks associated with investing in commercial real estate, including potential environmental risks;

• Potentially complex tax consequences;

• It is a newly formed business with no history of operations and only limited assets;

• Substantial fees and distributions are payable to the manager and its affiliates;

• Potentially significant conflicts of interest exist involving the manager and its affiliates.

• For additional risk factors, please see deal-specific PPM.

Any investor, who is making an investment in order to qualify for a 1031 tax-deferred exchange, (or a partial 1031 tax-deferred exchange), should consult with their attorneys, investment advisors, accountants and/or qualified intermediary as to whether or not their investment and the structure for their investment in a property would qualify, in whole or part, as a tax-deferred exchange. In any offering by Time Equities Securities LLC (‘TES’) of tenant in common interests to implement a 1031 tax-deferred exchange, TES, TEI and the principals of TEI shall not have any liability and/or obligations to an investor as to any such non-compliance and any income tax penalty that may be imposed on any such investor. Time Equities Inc. and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. This is not an offering. Offering of tenants in common interests to implement a 1031 tax-deferred exchange shall only be made through an offering by TES pursuant to a private investment memorandum. Time Equities, Inc. and Time Equities Securities LLC are affiliates. Securities offered through Time Equities Securities LLC, a member of FINRA.